operating cash flow ratio industry average

18000 2000 9. Depending on its lending guidelines this may or may not meet the banks loan requirements.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Price to Free Cash Flow FY--Price to Book MRQ 1370.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

. For example a company had in millions cash flow of 5000 and net sales of 9200 and its cash flow margin 5000 9200 x 100 543. Operating cash flow ratio is generally calculated using the following formula. Price to Tangible Book MRQ 1370.

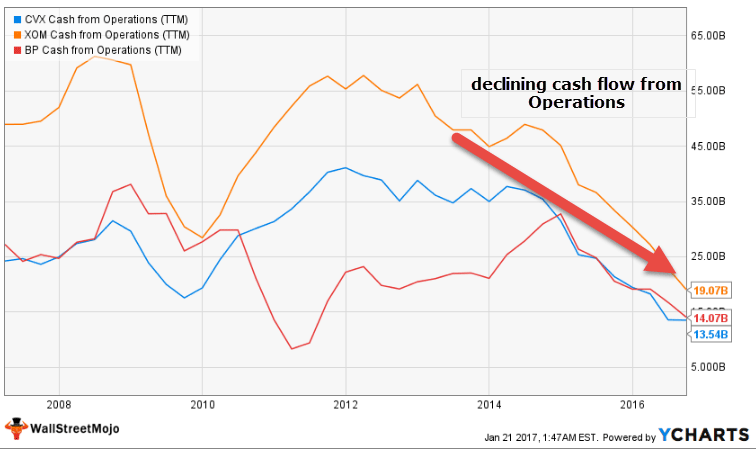

The credit analysts see the company is able to generate twice as much cash flow than what is needed to cover its existing obligations. Industry Comparisons 2017 Industry Average Current 27X Quick 10X Inventory turnover 61X. This compares to 14 for those industries with the largest cash balances at 20-40 of sales.

75 rows Cash Ratio - breakdown by industry. Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6. Financial Ratios for Industry In WRDS.

For a book about business ratios UCLA users can see Steven MBraggs Business Ratios and Formulas. This corresponds to a value of 1 or little higher than 1. Cash ratio is a refinement of quick ratio and.

In 2014 Times Interest Earned was. Price to Book FY 1509. During the past 5 years the average Operating Cash Flow per Share Growth Rate was 1640 per year.

Within Healthcare sector 2 other industries have achieved higher Free Cash Flow growth. Within Energy sector 4 other industries have achieved higher Working Capital Ratio. Other Ratios 69-72 70.

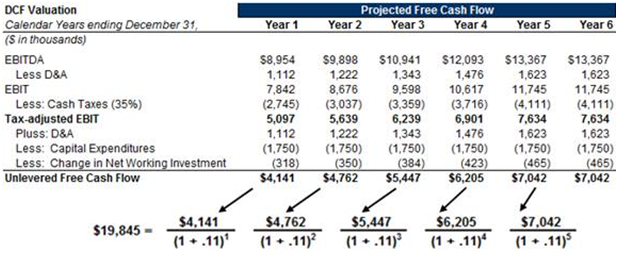

The Operating Cash Flow Ratio a liquidity ratio is a measure of how well a company can pay off its current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year. The user must understand how cash flow from operations is calculated. Price to Cash Flow FY 3877.

Free Cash FlowOperating Cash Flow. The operating cash flow ratio is a measure of a companys liquidity. Price to Free Cash Flow TTM 5690.

Interest coverage ratio. Pretret_noa Profitability Operating Income After Depreciation as a fraction of average Net Operating Assets NOA based on most. Targets operating cash flow ratio works out to.

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Price to Tangible Book - Common MRQ 1163.

Exhibit 1 shows a variety of ratios calculated from the financial statements of Boomtown and Circus Circus. WRDS Industry Financial Ratio. Operating Margin Income Tax Rate Net Profit Margin Return on.

Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio. Financial Soundness 36-51 39. Working Capital Ratio total ranking has deteriorated relative to the previous quarter from.

Cash flow coverage ratio 64000000 4000000 8000000 38000000 2. Free Cash FlowOperating Cash Flow. Price to Cash Flow MRQ 3486.

Free Cash Flow growth YY Annual Comment. A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities. During the past 3 years the average Operating Cash Flow per Share Growth Rate was 1830 per year.

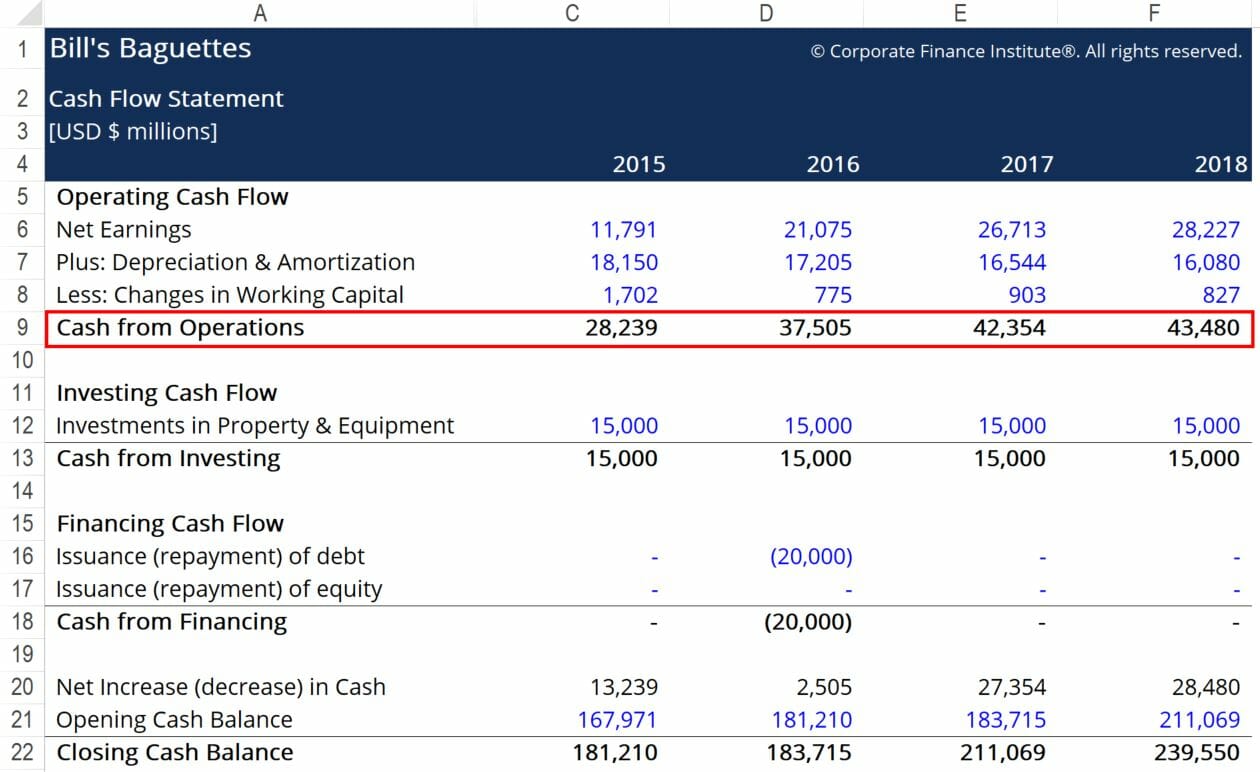

Cash Flow from Operations refers to the cash flow that the business generates through its operating activities. Operating cash flow ratio is generally calculated using the following formula. Operating and Financial Ratios.

Operating CFCurrent Liabilities. This number can be found on a companys cash flow. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet.

Other Ratios 69-72 71. 220 rows An acceptable current ratio aligns with that of the industry average or might be slightly higher than that. During the past 13 years Callaway Golf Cos highest 3-Year average Operating Cash Flow per Share Growth Rate was 16360 per year.

The Times Interest Earned Ratio is. Sequentially TTM Free Cash Flow grew by 6601. WRDS Research Team.

A company shows these on the with the cash flow Free Cash Flow FCF Free Cash Flow. Working Capital Ratio Comment. On the trailing twelve months basis.

During the past 3 years the average Operating Cash Flow per Share Growth Rate was 1830 per. Operating Cash Flow Ratio Operating Cash Flow Current Liabilities. Price Earnings Price Book Net Profit Margin Price to Free Cash Flow Return on Equity Total Debt Equity and Dividend Yield.

What is the Operating Cash Flow Ratio. Major Pharmaceutical Preparations Industrys pace of Free Cash Flow growth in 1 Q 2022 decelerated to 101 year on year below Major Pharmaceutical Preparations Industry average. Total Capital Return on Shareholder Equity Retained Earnings to Common Equity All Dividends to Net Profit Average Annual Price to Earnings Ratio Relative Price to Earnings Ratio Average Annual Dividend Yield.

Cash flow margin Cash flow from operating activities net sales x 100. Value Investment Funds Two 12 Year Running Average Annual Return After Quarterly. Industry Ratios included in Value Line.

WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial. On the trailing twelve months basis Due to increase in Current Liabilities in the 1 Q 2022 Working Capital Ratio fell to 039 below Oil And Gas Production Industry average. 75 rows Cash Ratio - breakdown by industry.

The formula to calculate the ratio is as follows. Price to Tangible Book FY 1634. A positive percentage here is a good indicator of business profitability and efficiency.

The operating cash flow refers to the cash that a company generates through its core operating activities. The figures cover the period from 1992 to 1996 although Circus Circus was on a January 31 fiscal year while Boomtown used a fiscal year ending September 30. Search this Guide Search.

Meaning the interest of The Learning Company was covered 9 times. Price To Cash Flow TTM 3584. The operating cash flow ratio is not the same as the operating cash flow margin or the net income margin which includes transactions that did not involve actual transfers of money depreciation is common example.

Research and DevelopmentSales.

Net Income Vs Cash Flow Accounting Interview Question

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Operating Cash Flow Ratio India Dictionary

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio Formula Example Calculation Analysis

Price To Cash Flow Formula Example Calculate P Cf Ratio

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Cash Flow Per Share Formula Example How To Calculate

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Cash Flow To Debt Ratio Meaning Importance Calculation